AI Investment Platforms are changing the way investors manage their money. These powerful tools use cutting-edge technology to analyze markets, optimize portfolios, and deliver better results.

With these platforms, novice and experienced investors gain advantages once reserved for large hedge funds. Not only do they simplify complex decisions, but they also identify opportunities faster than traditional methods.

This guide will explore how these revolutionary tools work, where you can find them, and how to choose the right solution for your goals.

Understanding AI Investment Platforms: A New Era of Smart Investing

AI Investment Platforms combine advanced algorithms with data-driven insights to help investors make better decisions. Unlike manual trading or research, these systems process countless data points every second.

They incorporate machine learning, predictive analytics, and real-time market analysis. These features allow them to spot emerging trends, adjust portfolios, and respond almost instantly to sudden market changes.

Key Features and Benefits of AI Investment Platforms:

- Real-time market scanning for fresh opportunities

- Reduced emotional bias, increasing objectivity

- Automated portfolio rebalancing to maintain optimal asset allocation

- Fast adaptation to market changes, limiting losses

- Integration with other tools, including Robo-Advisors, for efficient portfolio management

In recent years, AI-driven tools have grown significantly. According to industry reports, investors using these platforms have seen improved risk-adjusted returns. These systems learn and refine their models as more data becomes available, driving even better outcomes.

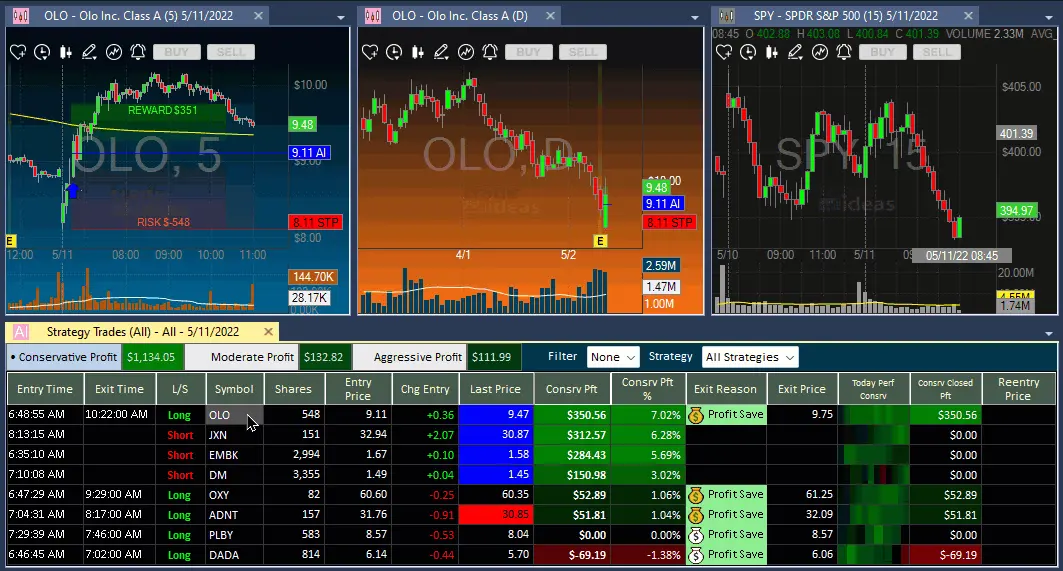

Trade Ideas

Trade Ideas utilizes advanced AI algorithms to provide real-time stock analysis and trading signals. Its AI system, HOLLY, evaluates numerous strategies daily to identify high-probability trades, making it a valuable tool for active traders.

TrendSpider

TrendSpider offers AI-powered chart pattern recognition and automated technical analysis. It enables traders to backtest strategies and set up automated trading bots, streamlining the trading process and enhancing decision-making.

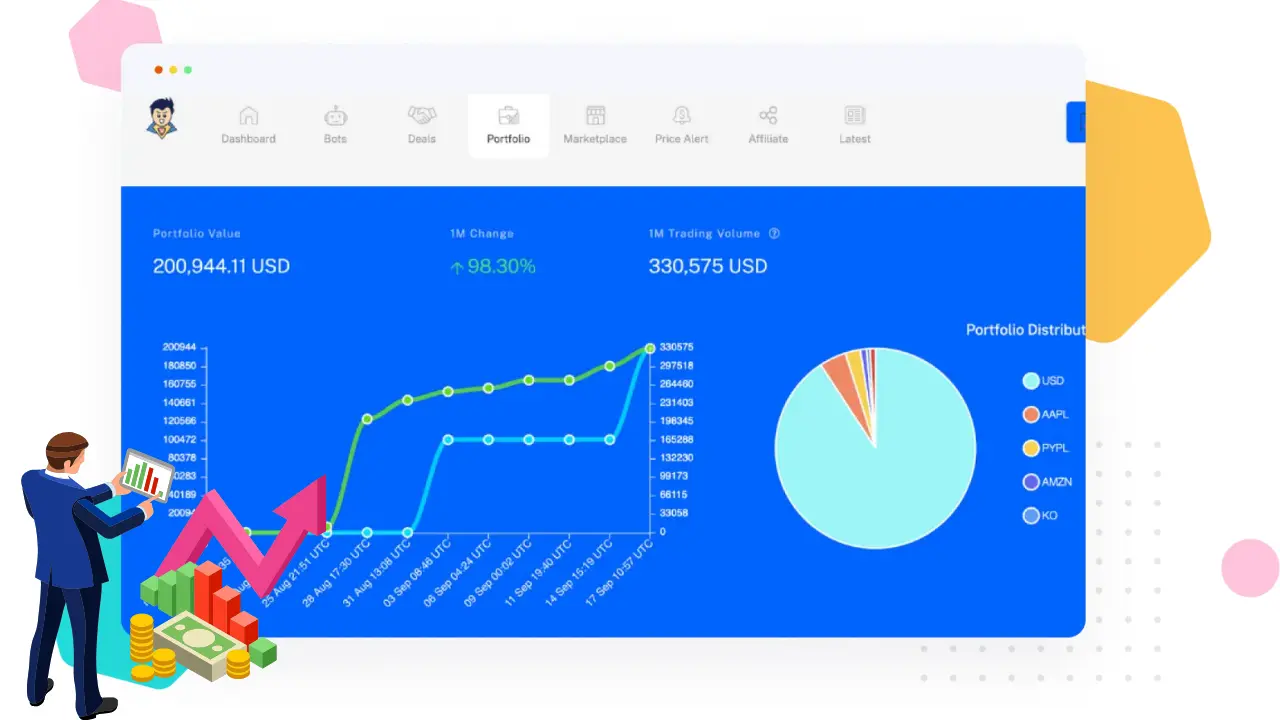

StockHero

StockHero allows users to create and deploy AI-driven trading bots across various brokers. With features like backtesting and a marketplace for strategies, it caters to novice and experienced traders seeking automation.

Magnifi

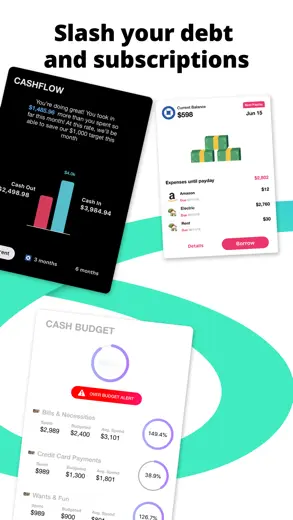

Clerkie

Clerkie uses AI to help consumers manage debt and improve financial health. It provides personalized recommendations and automates financial tasks as a comprehensive financial assistant.

These platforms exemplify the integration of AI in investment and trading, offering tools that enhance efficiency and decision-making for investors and traders alike.

Before embracing these innovations, it is important to understand their technology. AI Investment Platforms rely on several core elements:

- Machine Learning Models:

They analyze historical and real-time data, detecting patterns and correlations invisible to the human eye. - Predictive Analytics:

By leveraging forward-looking algorithms, these platforms forecast future trends, price movements, and volatility patterns. - Natural Language Processing (NLP):

NLP helps AI systems interpret financial news, social media posts, and earnings reports. As a result, they can gauge market sentiment and anticipate potential market shifts. - Automated Execution:

Trades occur at lightning speed, reducing lag and improving execution quality. Decisions made by the algorithm trigger immediate actions without manual intervention.

These technologies combine to form a powerful investment engine. Their synergy ensures faster decision-making, accurate forecasts, and a refined approach to building and maintaining portfolios.

Choosing the Right AI Investment Platforms for Your Needs

Not all AI Investment Platforms offer the same features. Some specialize in equities, while others focus on ETFs, bonds, or cryptocurrencies. To find the right fit, consider the following:

1. Investment Goals and Risk Appetite:

- Are you looking for growth, income, or diversification?

- Do you prefer short-term trading or long-term investing strategies?

2. Platform Fees and Costs:

- Check if the platform charges management fees, performance fees, or both.

- Review their pricing structure to ensure alignment with your budget.

3. Data Security and Privacy:

- Confirm that the platform uses robust encryption and secure data handling.

- Verify compliance with financial regulations and standards.

4. Quality of Customer Support:

- Look for responsive support channels, educational materials, and training resources.

- Platforms with dedicated account managers often offer more personalized guidance.

Top AI Investment Platforms to Watch

The marketplace features many options. Some platforms stand out for their reliability, advanced features, and user satisfaction. Although features change over time, the following solutions have earned respect in the investment community:

1. AlphaSense Robo-Advisors:

- Specializes in equities and ETFs

- Offers dynamic portfolio rebalancing

- Integrates with Asset Allocation Tools for seamless optimization

2. BetaQuant AI:

- Leverages deep learning models to spot market inefficiencies

- Delivers real-time alerts and signals

- Features robust sentiment analysis and news integration

3. GammaTrade Insights:

- Focuses on predictive analytics for emerging markets

- Provides simulated trading environments for practice

- Emphasizes user-friendly dashboards for beginners

Choosing the right tool depends on your unique goals. For instance, if you want a long-term investment approach, AlphaSense might be ideal. On the other hand, short-term traders could benefit from BetaQuant’s real-time alerts.

AI Investment Platforms and Portfolio Diversification

Diversification is essential for reducing risk. AI Investment Platforms help allocate assets across various sectors, geographies, and asset classes. These systems analyze correlations between different investments, ensuring your portfolio does not rely too heavily on one industry.

How AI Improves Diversification:

- Identifies low-correlation assets for balanced exposure

- Monitors market conditions that may influence asset relationships

- Automatically adjusts allocations as market dynamics shift

By maintaining a diversified portfolio, you protect yourself from unpredictable downturns. Over time, well-diversified strategies often yield more stable returns. This principle and AI’s rapid analysis set a strong foundation for consistent gains.

Strategies for Maximizing Returns with AI Investment Platforms

Investors who embrace AI Investment Platforms usually seek higher returns. To achieve this, consider these strategies:

1. Start Small and Scale Up:

Begin with a modest allocation to test the platform’s performance. As you gain confidence, gradually increase your stake.

2. Integrate Multiple Tools:

Combine the platform’s insights with traditional analysis or Algorithmic Trading Tools. Using several resources may enhance decision-making.

3. Rebalance Regularly:

Even though many AI platforms rebalance automatically, review your portfolio periodically. This ensures alignment with your evolving financial goals.

4. Stay Informed:

Keep up-to-date with market trends, industry news, and platform updates. Regular research, combined with AI guidance, can improve your long-term returns.

5. Monitor Performance Metrics:

Track key indicators like Sharpe ratios, return on investment (ROI), and maximum drawdowns. In doing so, you stay aware of performance patterns.

The Role of Human Expertise in AI Investment Platforms

Although AI Investment Platforms excel at data analysis, human expertise still matters. Experienced investors can provide context, judge market sentiment, and apply critical thinking. You create a more holistic approach by blending human intuition with AI-driven insights.

Experts often guide platform customization. They refine parameters, adjust risk settings, and review unusual signals. While AI handles bulk data processing, humans ensure the platform’s recommendations align with personal or institutional investment mandates.

Trends Shaping the Future of AI Investment Platforms

As technology evolves, so do investment methods. Current trends suggest an even brighter future for these platforms:

1. Increased Accessibility:

More user-friendly interfaces, lower fees, and widespread internet access make these tools available to a broader audience.

2. Greater Transparency:

Regulators encourage transparency. Expect more disclosures about algorithms, data sources, and decision-making processes.

3. Integration with Other Services:

AI platforms continue to connect with banking apps, tax software, and Cryptocurrency Exchanges, streamlining the entire financial ecosystem.

4. Ethical and Sustainable Investing:

Some platforms incorporate environmental, social, and governance (ESG) data. This helps socially conscious investors align their portfolios with personal values.

5. Mobile Optimization:

Many platforms now offer mobile apps. This ensures investors can monitor portfolios, receive alerts, and execute trades from anywhere.

Comparing AI Investment Platforms: A Quick Reference Table

Below is a brief comparison of three popular AI platforms:

| Platform | Asset Focus | Key Feature | Ideal For | Fee Structure |

|---|---|---|---|---|

| AlphaSense | Equities/ETFs | Dynamic Rebalancing | Long-term Investors | Moderate |

| BetaQuant | Multi-Asset | Real-time Alerts | Short-term Traders | Performance-based |

| GammaTrade Insights | Emerging Markets | Predictive Analytics | Growth-oriented Traders | Variable |

Risk Management with AI Investment Platforms

All investments involve risk. AI Investment Platforms help manage these risks by providing early warnings, setting stop-loss orders, and monitoring volatility.

Because these platforms analyze vast datasets, they can detect patterns that signal increased risk. This enables investors to respond quickly and adjust positions before significant losses occur.

Moreover, integrating these platforms with Risk Assessment Tools can further enhance decision-making. Investors gain confidence knowing that their strategies align with real-time market conditions, reducing uncertainty and preserving capital during challenging times.

FAQ: AI Investment Platforms

Are AI Investment Platforms suitable for beginners?

Yes. Many offer user-friendly dashboards, educational resources, and automated decision-making. Beginners can learn by observing the platform’s strategies and gradually gaining experience.

How much capital do I need to start using an AI Investment Platform?

Some platforms allow you to start with small amounts, such as a few hundred dollars. Check minimum deposit requirements, as they differ among providers.

Will AI Investment Platforms guarantee profits?

No platform can promise guaranteed returns. Market conditions change, and all investments carry risk. AI tools improve decision-making, but they do not eliminate risk.

Are my funds and personal data safe?

Reputable platforms follow strict security protocols. They use encryption, adhere to regulatory standards, and maintain secure servers. Always choose trusted providers and verify their data protection policies.

Can I combine AI platforms with traditional investment methods?

Yes. Many investors use AI-driven insights alongside traditional research. Combining both methods often produces a more well-rounded strategy.

Enhancing Your Knowledge with Additional Resources

If you want to learn more about AI Investment Platforms, explore additional materials:

- Online Courses:

Find courses on machine learning, quantitative trading, and investment analytics. - Industry Reports:

Read annual reports from leading financial institutions. They often discuss AI integration and market trends. - Webinars and Podcasts:

Join webinars hosted by experts and tune into podcasts covering technology-driven investing strategies.

These resources help refine your understanding and update you on the latest developments.

Practical Tips for Implementing AI Investment Platforms Successfully

Adopting AI Investment Platforms requires planning and discipline. Use the following tips:

- Set Clear Objectives:

Define your investment horizon, return targets, and acceptable risk levels. - Diversify Across Tools:

Experiment with multiple AI platforms to see which aligns best with your style. - Track Your Progress:

Maintain records of trades, returns, and performance metrics. Over time, evaluate which strategies worked well. - Stay Adaptable:

As market conditions evolve, be ready to adjust. Platforms update models so they remain flexible and open to change. - Continue Learning:

Technology evolves rapidly. Keep expanding your knowledge and embrace continuous improvement.

Conclusion:

AI Investment Platforms are revolutionizing the investment landscape. Leveraging advanced algorithms, machine learning models, and predictive analytics, these tools help investors identify opportunities, manage risk, and adapt to changing conditions. While no system can guarantee returns, adopting these platforms can improve the quality of your decisions and enhance your overall investment experience.

As you venture into AI-driven investing, remember to set clear goals, remain patient, and continue learning. By doing so, you position yourself to harness the power of emerging technologies. With the right approach, these platforms can boost your returns and elevate your financial success.