Start today to slash your monthly expenses and discover how to control your finances better. Many people feel anxious about rising costs, especially when essential bills seem impossible to reduce. However, making small, consistent changes can yield remarkable results.

This comprehensive guide presents 10 easy tips for managing your money more effectively, all while keeping your confidence intact and your wallet protected. By focusing on these suggestions, you can quickly reduce your monthly bills, decrease monthly outgoings, and boost your savings account.

This article provides actionable advice on everything from negotiating bills to learning clever ways to shop. Read on to see how you can start saving now.

Tip 1: Assess Your Current Budget

One of the first steps to slash your monthly expenses is understanding where your money goes. Gather bank statements, bills, and receipts to see how much you spend on necessities, entertainment, and other categories. This assessment will help you cut household costs by identifying patterns of waste or overspending.

How to Start Tracking Your Expenses

- Create a Spreadsheet: List all your income sources and monthly expenses. Include rent or mortgage, utilities, groceries, car payments, etc.

- Use Budgeting Apps: Some apps can categorize your spending automatically. They give you a visual snapshot of how much you spend on various items.

- Review Every Transaction: Check for errors or unjustified fees. Sometimes, noticing a duplicate charge or a monthly subscription you forgot about can save money each month immediately.

- Set Monthly Targets: Decide how much you want to decrease your monthly outgoings. Assign a target for each spending category to maintain accountability.

Tip 2: Negotiate Better Rates and Contracts

Negotiating contracts can slash your monthly expenses dramatically when it comes to recurring bills like phone, internet, or cable. Many service providers offer promotional rates, loyalty discounts, and special packages if you try to ask.

Negotiation Strategies

- Research Competitors: Compare offers from rival companies to strengthen your position when you negotiate.

- Call Customer Service. Politely state that you’re considering switching. Representatives often have the power to offer special deals on the spot.

- Bundle Services: Internet, cable, and phone packages typically offer bundled discounts.

- Check Contract Terms: Look for opportunities like contract expirations to renegotiate rates without early termination fees.

If you’re still paying full price for some memberships, remember that many gyms, streaming services, and other subscriptions have discounted or seasonal promotional rates. Reducing these costs consistently will help you trim your monthly spending and maximize savings.

Tip 3: Embrace Frugal Living Strategies in Everyday Life

Frugal living doesn’t mean sacrificing quality of life. It’s about focusing on priorities, avoiding excess, and making calculated decisions to lower living expenses.

Daily Actions to Help You Slash Your Monthly Expenses

- DIY Basics: Instead of paying for repairs, try fixing minor issues yourself. Search for tutorials or refer to home maintenance tips on our site to get started.

- Avoid Impulse Buys: Wait at least 24 hours before purchasing non-essentials. This pause helps prevent regretful spending.

- Prioritize Needs over Wants: Make lists and distinguish between items you need versus those you want.

When combined, these tiny changes yield significant monthly savings. Additionally, a frugal mindset encourages sustainable habits that contribute to personal finance goals and environmental benefits.

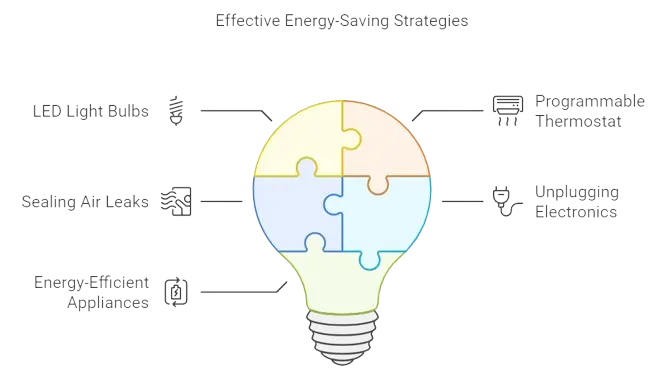

Tip 4: Cut Household Costs Through Energy Efficiency

Another impactful way to reduce monthly expenses is to improve energy efficiency. Simple measures can lower utility bills, often accounting for a significant portion of monthly expenditures.

Tactics to Reduce Your Monthly Bills on Utilities

- Upgrade to LED Bulbs: LED light bulbs use up to 75% less energy and can last 25 times longer than incandescent bulbs.

- Unplug Devices: Chargers, TVs, and computers consume power even when idle.

- Seal Windows and Doors: Prevent air leaks and reduce heating or cooling costs.

- Smart Thermostats: Invest in programmable thermostats to optimize heating and cooling schedules.

Making these adjustments helps you cut household costs and lessens your carbon footprint.

Tip 5: Lower Living Expenses by Reducing Transportation Costs

Transportation can take a considerable chunk of your paycheck each month. Lower your living expenses by minimizing spending on gas, maintenance, or public transportation tickets. This will free up cash for other priorities.

Cost-Effective Ways to Commute

- Carpool or Ride-Share: Splitting the cost of fuel and tolls can slash your monthly expenses significantly.

- Use Public Transportation: Buses, trains, or subways often cost less than car ownership.

- Optimize Car Maintenance: Regular tune-ups keep your car running efficiently and prevent costly repairs.

- Consider Alternatives: Walking or biking provides health benefits while saving on gas and parking fees.

Tip 6: Save Money Each Month on Groceries and Dining

Food costs can balloon if left unmanaged. Planning meals and shopping wisely will help you decrease monthly outgoings without compromising taste or nutrition.

Proven Grocery Hacks

- Meal Planning: Plan your meals weekly. That way, you shop with purpose and buy only what you need.

- Buy in Bulk (Selectively): Items like rice, pasta, and cleaning supplies usually cost less per unit when purchased in larger quantities.

- Use Coupons and Loyalty Programs: Check digital and paper coupons before shopping. Many stores offer membership cards that help you accumulate points or enjoy discounts.

- Limit Takeout: Keep restaurant meals as treats rather than daily occurrences.

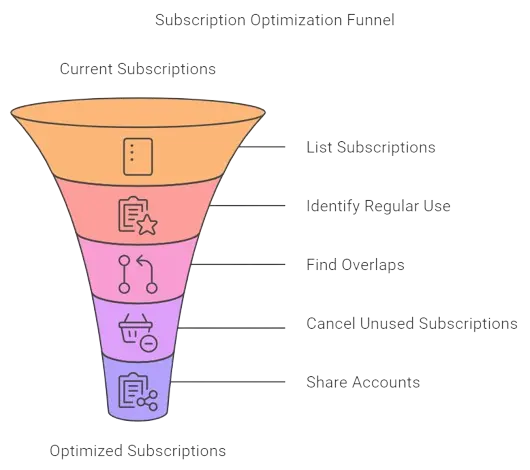

Tip 7: Decrease Monthly Outgoings by Eliminating Wasteful Spending

Sometimes, small leaks make a big hole in your finances. Subscriptions, unused memberships, and overlooked fees can quietly drain your wallet. Therefore, auditing recurring costs can help you slash your monthly expenses even further.

Steps to Cut Hidden Expenses

- Cancel Unused Subscriptions: If you haven’t opened a service in months, it’s time to cancel it.

- Review Bank Statements Weekly: Identify any unexpected charges or monthly fees.

- Say “No” to Late Fees: Set automatic payments or reminders to avoid penalties.

- Switch to Free Services: Many paid apps have free alternatives that offer similar features.

Reevaluate your spending habits regularly, and direct the money you save toward more meaningful goals, such as an emergency fund or investment account.

Tip 8: Implement Budgeting Tips to Decrease Expenses

When you create a budget, you give every dollar a purpose. Once you have a clear plan, it’s much easier to slash your monthly expenses because you know exactly where your money goes.

Practical Budgeting Tips to Decrease Expenses

- Use the 50/30/20 Rule: Spend 50% on needs and 30% on wants, and allocate 20% for savings or debt reduction.

- Incorporate Sinking Funds: Save monthly small amounts for future significant expenses such as holidays or car repairs.

- Automate Your Savings: Set up an automatic deposit from your checking to your savings account.

- Track Progress: Review your budget weekly or monthly to see how well you adhere to it.

Budgeting offers a systematic route to lowering living expenses. For more advice on structuring your finances, check out our Comprehensive Budget Planning for step-by-step instructions.

Tip 9: Use Expense Reduction Techniques for Entertainment and Leisure

Many individuals overspend on entertainment, but you can still have fun while learning to slash your monthly expenses. Look for deals on streaming services, events, or hobbies without sacrificing enjoyment.

Affordable Entertainment Options

- Matinee Movies or Discounts: Some theaters offer reduced pricing during off-peak hours.

- Library Membership: Libraries carry free books, movies, and even games.

- Community Events: Local festivals often have free admission or low-cost activities.

- Subscription Swaps: Everyone can save if you share streaming platform costs with friends or family.

Maintaining a balanced lifestyle without overspending is possible. Many free or low-cost activities exist that can enrich your social life.

Tip 10: Manage Monthly Finances Effectively With a Strategic Mindset

Developing a strategic mindset is the final and perhaps most critical step in slashing monthly expenses. You’ll see improvements in every aspect of your budget when you consistently monitor your finances, set goals, and maintain discipline.

Keys to Strategic Financial Management

- Set Financial Goals: Whether you’re saving for a vacation, a house down payment, or an emergency fund, keep your targets visible.

- Monitor Credit Card Usage: Pay balances on time and aim to avoid high-interest debt.

- Review Insurance Plans: Regularly compare health, car, and home insurance rates to ensure you pay competitive premiums.

- Seek Professional Guidance: Consult a financial advisor for tailored advice if your finances are complex.

Strategic financial management ensures you stay on track with your savings, investments, and expense reduction techniques. Following these principles can build a more secure financial future for yourself and your family.

Additional Resource Table: Potential Monthly Cost Savings

Below is a quick-reference table for areas where you might reduce your monthly expenses. The table suggests potential savings for each location, but the amounts can vary depending on your lifestyle.

| Expense Category | Possible Monthly Savings | Key Action |

|---|---|---|

| Utilities (Electric, Water) | $20 – $50 | Install smart thermostat, seal gaps |

| Groceries & Dining Out | $50 – $100 | Meal planning, use coupons |

| Transportation (Gas & Commute) | $30 – $80 | Carpool, maintain vehicle |

| Entertainment (Streaming etc.) | $15 – $40 | Cut duplicates, use free library |

| Subscriptions & Memberships | $10 – $30 | Cancel unused services |

| Insurance (Car, Health) | $20 – $60 | Compare rates, negotiate |

| Phone & Internet Plans | $15 – $50 | Research promotions, bundle deals |

Reviewing each category systematically will show how much extra money can be redirected to your savings or investments.

FAQ

1. How can I start to slash my monthly expenses quickly?

Begin with a budget review. Identify immediate changes, such as canceling unnecessary subscriptions or switching to lower-cost services. Then, look for ways to reduce high-value items such as rent, insurance, and utilities.

2. What are some common mistakes when trying to lower living expenses?

A common pitfall is cutting back too aggressively in essential areas like nutritious food or reliable transportation. Another mistake is failing to track progress and reverting to old habits. Consistency is crucial.

3. Can I still enjoy life if I cut household costs?

Absolutely! Frugal living strategies focus on reducing waste and prioritizing what truly matters. If you plan carefully and take advantage of deals or freebies, you can still enjoy entertainment, restaurants, or hobbies.

4. Which budgeting tips to decrease expenses are most effective?

The 50/30/20 rule, meal planning, and sinking funds are frequently cited as very effective. Automating your savings also helps reduce human error or forgetfulness.

5. Are expense reduction techniques sustainable in the long run?

Yes. Gradual and mindful changes are more sustainable than drastic cuts. Over time, good habits like regularly reviewing bills or negotiating contracts become second nature.

6. What if I have already trimmed most of my discretionary spending?

Then,, it’s time to consider ways to lower fixed costs, such as negotiating better insurance rates, downsizing living space, or seeking cheaper loan terms. Continuously review every aspect of your budget.

7. Is professional help necessary to manage monthly finances effectively?

It depends on your financial complexity. Consulting an advisor can save you significant time and money if you have multiple income streams, sizable investments, or complicated tax situations.

Conclusion

Learning to slash monthly expenses is not just about cutting back on non-essential items; it’s about making strategic choices that offer long-lasting benefits.

Assessing your current budget, negotiating better rates, embracing frugal living strategies, and cutting household costs can help you on a clear path to sustainable financial wellness.

In addition, lowering living expenses in one area often fuels savings in another. For example, trimming your monthly grocery spending can divert that money to debt repayment or an emergency fund.

Remember that spending wisely can reduce monthly bills, manage finances effectively, and enhance enjoyment. Whether you’re looking to cut household costs, lower your monthly bills, or save money each month, these 10 easy tips offer a starting point for lasting change.

Incorporate them systematically, monitor progress, and watch as your bank balance grows. Most importantly, remain flexible. Over time, your monthly expenses may shift, so revisit your budget plan regularly. That way, you’ll stay in control, build a more secure future, and maintain a mindset focused on success.